Missteps Can Lead to The Greatest Strides

How Forgetting One’s Wallet Affected the Contents of Every Wallet Thereafter.

In 1949, businessman Frank X. McNamara forgot his wallet while dining out at a New York City restaurant. Cheeky trick. Fortunately, his wife rescued him and paid the tab. It was an embarrassment he resolved never to face again. Legend has it this was the true start of the feminist movement.

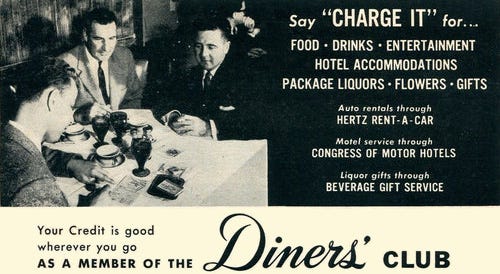

One year later, February 1950: McNamara returned to Major’s Cabin Grill with his partner and trusted attorney, Ralph Schneider. When the bill arrived this time, McNamara paid with a small cardboard card, known today as a Diners Club Card. This event was hailed as the “First Supper,” paving the way for the world’s first multipurpose charge card. Diners Club made its mark on history becoming the world’s first independent credit card company. ( A charge card as distinguished from a credit card, as it requires paying off your full balance once a month.)

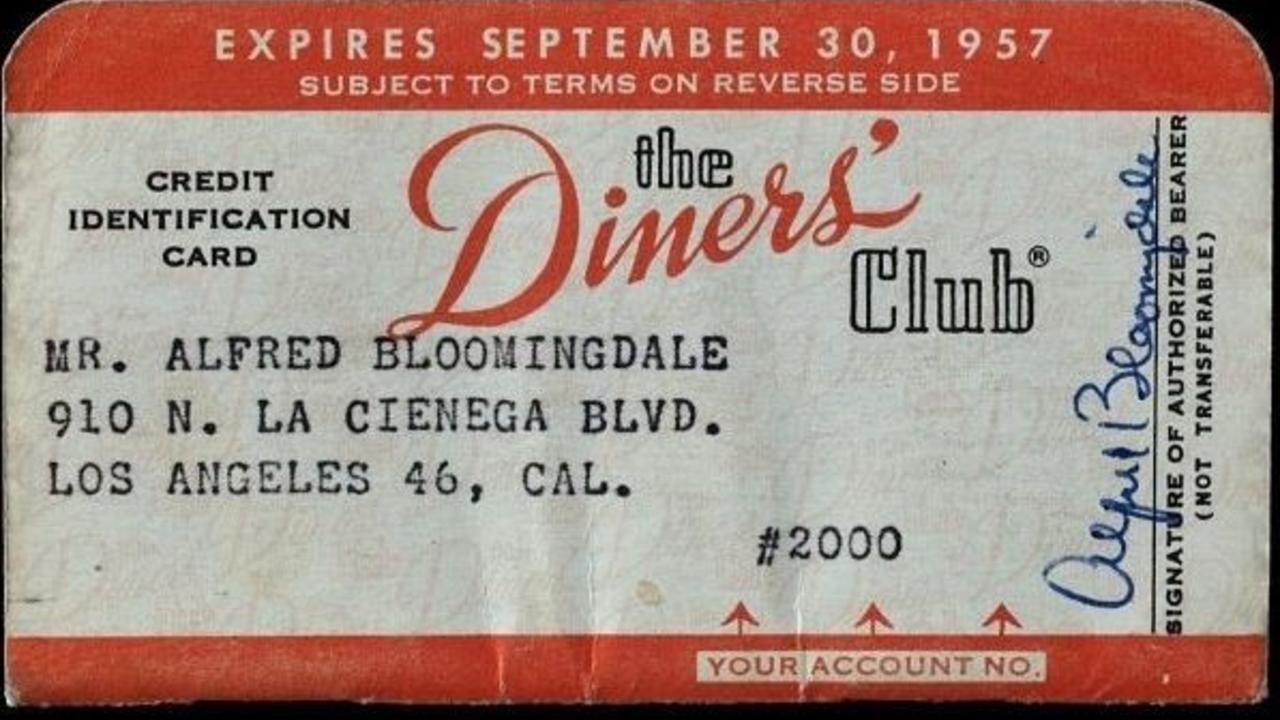

In its first year of business, Diners Club grew to 10,000 members from New York’s business elite, with 28 restaurants and two hotels prepared to accept monthly billing in respect of this select clientele. Imagine had they uncovered the windfalls of offering different colored cards to attribute prestige and panache to an otherwise bland wallet. In 1952, McNamara decided to sell his share of the company to Schneider and Alfred S. Bloomingdale ( yes, THAT Bloomingdale) for a grand total of $200,000.

In the 1950s, Diners Club led the way in credit card innovation by introducing a travel insurance policy. 1958 was a monumental year for Diners Club Card as it had its first TV ad as a sponsor of the NY Giants (Go Blue!)… and they go onto to win their Conference that year, to no small part due to the nourishment attained while utilizing the Diners Club Card.

The cardboard card turned plastic in the 1960s, and bewitched Audrey Hepburn in the classic film “Breakfast at Tiffany’s”.

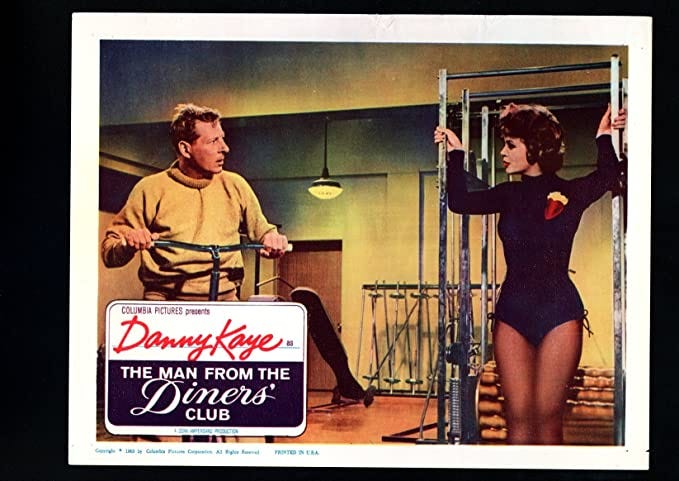

In 1963, Diners Club received some free mainstream publicity with the release of the classic film, The Man From The Diners’ Club. Focusing on travel and leisure, Diners Club consolidated a loyal diehard customer base of frequent travelers, which they maintain into the present day. Well, sorta. While growth and profit remained strong, Diners Club did not do quite as well among other demographics, allowing MasterCard and Visa to expand and take control of the American credit card industry. In the 1970s, Diners Club launched its first range of corporate cards and, one decade later, lived up to its reputation as the pioneer of the industry with the introduction of Club Rewards.

The Citi That Never Sleeps

In 1981, Citi bought out Diners Club International, the entity that owns the trademarks and payment network. As the owner and operator of Diners Club in North America, Citi decided to dismantle Diners Club’s payment acceptance network within the region. As a result, the Diners Club payment network ceased to exist in North America, even as the card was still widely accepted outside the region. This opened a can of worms (escargot, technically speaking), as merchants in North America would not be able to accept Diners Club cards. To remedy this problem, Citi negotiates with MasterCard in 2004 to bring Diners Club onto the MasterCard network in the U.S. and Canada. From this point, Diners Club became a MasterCard in terms of payment acceptance and merchant recognition, while maintaining its moniker as payments for palettes (a little alliteration license please).

On December 31, 2009, BMO Financial Group acquired the Diners Club North American franchise. The agreement gives BMO Financial Group exclusive rights to issue Diners Club Cards to corporate and personal clients in the U.S. and Canada. This would have worked marvelously if denture adhesive were given with each card issuance as all cardholding members are now rather long in the tooth.

I digress … this latter decline in no way diminishes the exploits of a couple of smart fellas with a good idea, perseverance, and an industrious spirit. A reliable wife is also essential.

Now for the pitch. If you too have a brilliant idea and need to expand your growth (prior to selling to your partners for a pittance), contact Shield Advisory Group. We know small business owners need more than just a check. Our Business Advising Program gives Main Street businesses the same tools and resources that bigger companies have.

Published By Luigi Rosabianca of Shield Advisory Group.

Originally published at https://www.linkedin.com